Retirement due to ill health

The Trustee can grant you a full (unreduced) pension, subject to you providing satisfactory medical evidence. A medical consultant must certify, to the satisfaction of the Trustee, that you are permanently unfit because of ill health or incapacity for any form of paid employment or self-employment. Your pension will be the amount of your deferred pension revalued to the date of retirement and will not have any reductions applied for early payment.

Ensign Retirement Plan members

If you were an active member of the MNOPF at 31 March 2016, contributed to the Ensign Retirement Plan (for the MNOPF) from 1 April 2016 to 31 march 2018, and you continue to contribute to the Ensign Retirement Plan from 1 April 2018, you will continue to be entitled to an unreduced early retirement pension and lump sum benefit in the event of ill health upon production of an ENG3 form or another medical certificate acceptable to the Trustee. Please be aware that, following a re-fresh of the brand, the Ensign Retirement Plan is now known as Ensign.

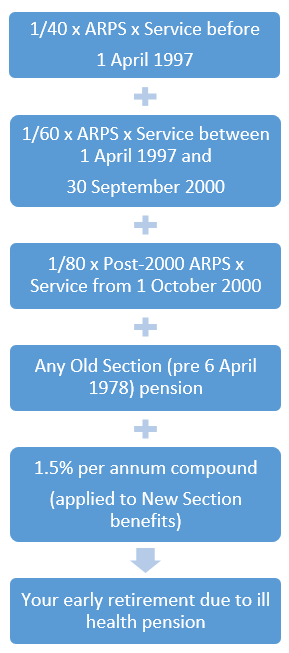

If the Trustee agrees to retirement on the grounds of ill health you will receive a pension of:

1/40 x ARPS x Service before 1 April 1997,

plus 1/60 x ARPS x Service between 1 April 1997 and 30 September 2000,

plus 1/80 x Post-2000 ARPS x Service from 1 October 2000,

plus Any Old Section (pre 6 April 1978) pension,

plus 1.5% per annum compound (applied to New Section benefits).

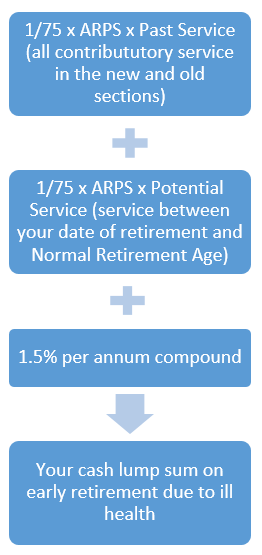

In addition, if you have been an active, contributing member immediately before the date you were certified as medically unfit for sea service, you will receive a cash lump sum, as follows:

1/75 x ARPS x Past Service (all contributory service in the new and old sections),

plus 1/75 x ARPS x Potential Service (service between your date of retirement and Normal Retirement Age),

plus 1.5% per annum compound.

There are limits to the amount of cash you can take. More details are given in the options at retirement section.

If you qualify for the Additional One Year’s Credit , your pension will be increased by 1/40 x ARPS.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

If you retire on the grounds of ill health but later recover sufficiently that you are able to take up seagoing employment again, your pension will be suspended from the date your new employment starts. Your pension would then be reinstated from your Normal Pension Age (NPA).

If you retire on the grounds of ill health but later recover sufficiently that you are able to earn an income from employment or self-employment, your pension may be suspended.

Once your pension starts, certain parts of your pension may be granted increases. See pension payments for more details.