Death benefits after retirement

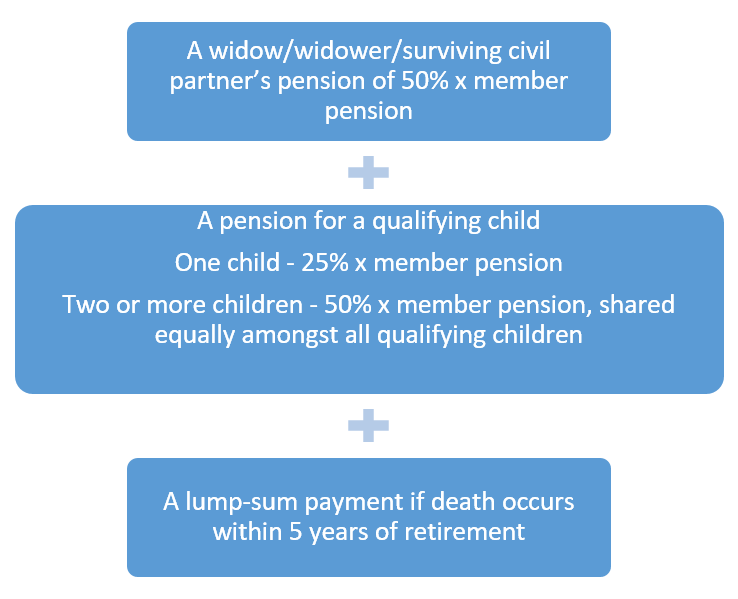

If you die after you have started to receive your pension, the following benefits will be payable:

A widow, widower or surviving civil partner's pension of 50%, times member pension,

plus a pension for a qualifying child where one child = 25% times member pension, and two or more children = 50% times member pension, shared equally amongst all qualifying children,

plus a lump-sum payment if death occurs within 5 years of retirement.

The widow/widower/surviving civil partner’s and child’s pension are based on your pension at retirement and ignore any reductions for early retirement or if you took cash at retirement. They do, however, include any increases to your pension made from your retirement date to your date of death.

Widow/widower/surviving civil partner's pensions are payable for life. However, a child’s pension is only paid up until they stop meeting the qualifying conditions.

If there is no widow/widower/surviving civil partner’s pension to be paid, the child’s pension will be doubled.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

Pension increases

More information on increases to pensions can be found here.

If you die within 5 years of retiring (regardless of whether this happens before, at or after Normal Pension Age) a lump sum is paid which is equal to the pension instalments that would have been paid over the remainder of the 5 year period.

This lump sum is paid in addition to the benefits under Death benefits after retirement above. Make sure you have completed an Expression of Wish form so that the Trustee knows who you want to receive your death benefits.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

A child’s pension will be payable if they meet qualifying conditions. The pension payable is:

- For one child – 25% x member’s pension at date of death

- For two or more children – 50% x member’s pension at date of death, shared equally between all qualifying children

If there is no widow/widower/surviving civil partner's pension payable, the child’s pension will be double the standard amount shown above.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

If you get married after retirement, but die within 6 months of marriage, the payment of a full widow/widower/surviving civil partner’s pension would be at the discretion of the Trustee.

However, if you were in contracted out employment between 6 April 1978 and 5 April 1997, your widow/widower/surviving civil partner would receive a minimum of the widow, widower, or surviving civil partner’s GMP.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

This may apply to you if you have benefits in the Old Section (pre 6 April 1978) of the MNOPF. If you only have benefits in the New Section (6 April 1978 to 31 March 2016), this benefit will not apply to you.

If you are not legally married at the date of your death it is up to the Trustee to decide whether or not to pay widow/widower/surviving civil partner’s benefits to your partner. It will depend on whether, in the opinion of the Trustee, your partner depended on you to provide some or all of the basics to live.

The pension payable would be an amount not exceeding 50% of your Old Section pension.

You can nominate a partner (who may be the same sex as you) using an Expression of Wish form and the Trustee will take your wishes into account when deciding who to pay death benefits to.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.