Death benefits before retirement

If you should die before you start to draw your pension, the benefits payable will depend on whether you are under or over Normal Pension Age (NPA).

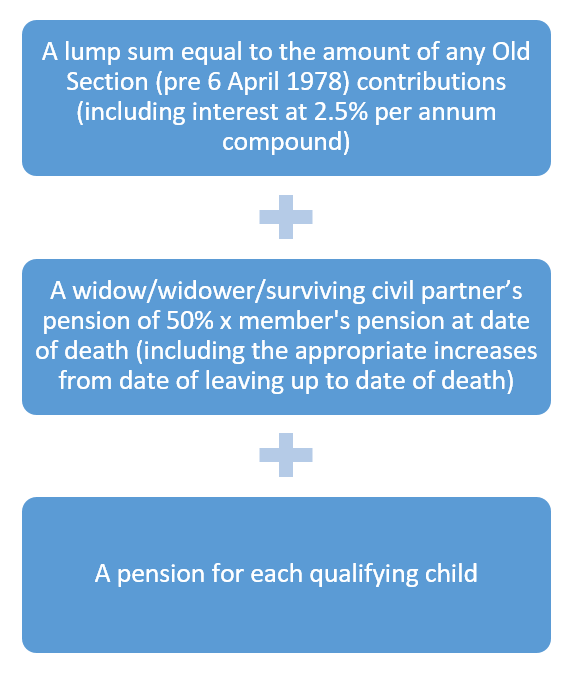

If you die after leaving service, but before Normal Pension Age, the following benefits will be payable:

A lump sum equal to the amount of any Old Section (pre 6 April 1978) contributions (including interest at 2.5% per annum compound),

plus a widow, widower or surviving civil partner's pension of 50%, times member's pension at date of death (including the appropriate increases from date of leaving up to date of death),

plus A pension for each qualifying child.

If you do not have a surviving spouse, civil partner or children, a lump sum equal to the value of your New Section (6 April 1978 to 31 March 2016) contributions, with interest at 2.5% per annum compound, is payable in addition to any Old Section (pre 6 April 1978) refund of contributions.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

For members who left service before 1 December 1992, they are treated in the same way as the death of a deferred member under Normal Pension Age, as described in the section above.

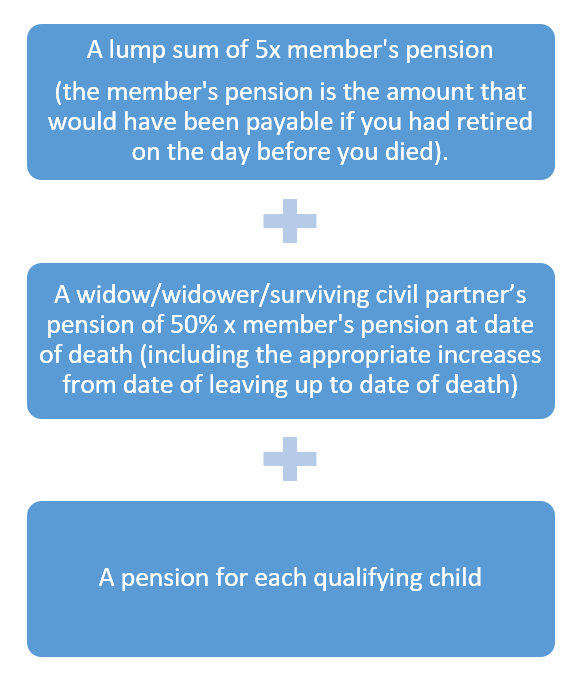

For members who left service after 1 December 1992, if you die after leaving service and after Normal Pension Age, but before you have started to take your pension, the following benefits will be payable:

A lump sum of 5 times member's pension (the member's pension is the amount that would have been payable if you had retired on the day before you died).

Plus a widow, widower or surviving civil partner's pension of 50%, times member's pension at date of death (including the appropriate increases from date of leaving up to date of death),

plus a pension for each qualifying child.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

A child’s pension will be payable if they meet qualifying conditions. The pension payable is:

- For one child – 25% x member’s pension earned to date of death

- For two or more children – 50% x member’s pension earned to date of death, shared equally between all qualifying children

If there is no widow/widower/surviving civil partner's pension payable, the child’s pension will be double the standard amount shown above.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

This may apply to you if you have benefits in the Old Section (pre 6 April 1978) of the MNOPF. If you only have benefits in the New Section (6 April 1978 to 31 March 2016), this benefit will not apply to you.

If you are not legally married at the date of your death it is up to the Trustee to decide whether or not to pay widow/widower/surviving civil partner's benefits to your partner. It will depend on whether, in the opinion of the Trustee, your partner depended on you to provide some or all of the basics to live.

The pension payable would be an amount not exceeding 50% of your Old Section pension.

You can nominate a partner (who may be the same sex as you) using an Expression of Wish form and the Trustee will take your wishes into account when deciding who to pay death benefits to.

Once a widow/widower/surviving civil partner's, partner’s or child’s pension has started, parts of the pension may be granted increases. More information can be found under Pension payments.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.